🏢 Glimmer Finance — The First Real-World Asset Marketplace on Solana

Imagine owning a piece of a Manhattan penthouse, a gold bar, or a vintage Ferrari — all for the price of a coffee. Sounds like a dream, right? Welcome to Glimmer Finance, a decentralized marketplace on the Solana blockchain that's turning this dream into reality by tokenizing real-world assets (RWAs). Whether you're a crypto newbie or a seasoned investor, Glimmer Finance offers a transparent, accessible, and innovative way to invest in assets once reserved for the ultra-wealthy. And with its ongoing $GLIMM token presale — where prices rise as time progresses — now's the perfect moment to dive in.

In this article, we'll explore how Glimmer Finance is revolutionizing asset trading, why Solana is the ideal blockchain for this mission, and how you can join the presale to be part of this groundbreaking ecosystem. Let's break it down.

Why Glimmer Finance Matters

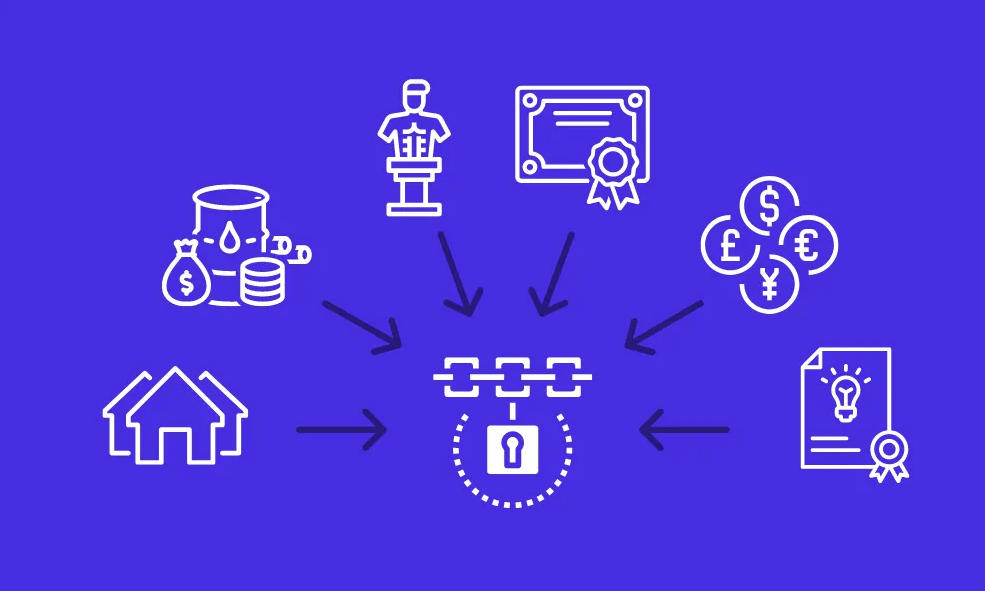

The world of finance is changing. Traditional investments like real estate or commodities often come with high barriers — think million-dollar price tags or complex legal processes. Glimmer Finance tears down these walls by tokenizing RWAs, allowing anyone to own a fraction of high-value assets. Built on Solana, known for its lightning-fast transactions and low fees, Glimmer ensures a seamless experience that's both secure and cost-effective.

What sets Glimmer apart? It's not just about trading tokens; it's about democratizing wealth. By leveraging Solana's scalability and AI-driven tools, Glimmer makes investing inclusive, transparent, and smart. As reported by CryptoPotato, Glimmer Finance is the world's first RWA presale on Solana, marking a pivotal moment in bridging traditional finance with Web3.

How Glimmer Finance Works

Glimmer Finance simplifies the complex world of RWA investment into a user-friendly platform. Here's how it brings tokenized assets to life:

1. Asset Tokenization

Asset owners can onboard their properties, commodities, or luxury goods through a rigorous process:

- Submission: Owners provide proof of ownership, valuations, and legal documents.

- Verification: Glimmer's AI and compliance teams ensure everything checks out.

- Tokenization: Approved assets are converted into digital tokens via smart contracts.

- Listing: Tokens are listed on the marketplace for trading.

This process ensures transparency and trust, with all transactions recorded on Solana's immutable blockchain.

2. Fractional Ownership

Glimmer's standout feature is fractional ownership, which lowers the entry barrier for investors. For example:

- A $1 million property can be split into 1 million tokens.

- You could own a piece for just $1, gaining exposure to real estate appreciation or rental income.

This approach enhances liquidity and diversifies portfolios, making high-value assets accessible to all.

3. AI-Powered Insights

Glimmer integrates artificial intelligence to supercharge decision-making:

- Asset Selection: AI identifies high-potential assets for tokenization.

- Market Predictions: Real-time analytics provide insights into trends and risks.

- Risk Assessment: Tools like the "Average Risk Score" help you evaluate investments.

These features empower users to invest smarter, not harder.

The Power of Solana

Why Solana? It's the backbone that makes Glimmer Finance possible. Solana's architecture, with its Proof-of-History consensus, handles over 50,000 transactions per second, making it the fastest blockchain for RWA trading. Its low transaction costs — often fractions of a cent — ensure that investors keep more of their returns. As noted in a Medium article by the Harkness Institute, Solana's scalability and robust ecosystem make it ideal for RWA projects like Glimmer.

Solana's recent milestones, like Homebase tokenizing a rental property, show its real-world potential. Glimmer builds on this foundation to create a marketplace that's fast, secure, and globally accessible.

The $GLIMM Token and Presale Opportunity

At the heart of Glimmer Finance is its native token, $GLIMM, which powers the ecosystem. With a total supply of 5 billion tokens, $GLIMM offers multiple utilities:

- Fee Discounts: Pay lower trading fees by holding $GLIMM.

- Staking Rewards: Earn passive income with attractive APYs.

- Governance: Vote on platform decisions.

- Liquidity Incentives: Get rewards for supporting trading pairs.

The $GLIMM presale is live now, but act fast — the price increases as the presale progresses. Currently, 30% of the token supply is allocated to the public sale, with 5% unlocked at the Token Generation Event (TGE) and the rest vesting over 14 months. This structure ensures steady growth and long-term value.

Join the presale today using this referral link: https://glimmer.finance/SEXeAPgIZLu7. By participating, you're not just investing in tokens — you're securing a stake in the future of decentralized finance.

Key Features of the Glimmer Marketplace

Glimmer's marketplace is designed for both novice and expert investors. Here are its standout features:

- Diverse Assets: Trade real estate, commodities, luxury goods, and more.

- Real-Time Liquidity: Buy and sell instantly with AI-driven pricing.

- User-Friendly Design: Navigate the platform with ease, regardless of experience.

- Blockchain Transparency: Every transaction is recorded on Solana's ledger.

These features make Glimmer a one-stop shop for RWA investing, as highlighted in posts on X praising its accessibility and AI integration.

Security and Compliance

Investing in RWAs requires trust, and Glimmer delivers with robust security and compliance measures:

- KYC/AML: Partnered with Parallel Markets for fast, secure identity verification.

- Data Protection: AES-256 encryption and GDPR-compliant storage safeguard user data.

- Smart Contracts: Automated, transparent transactions reduce intermediary risks.

These protocols ensure a safe environment, building confidence for users worldwide.

https://medium.com/media/4a1b3bcff6f81ffcf8e6f1132fbce681/hrefThe Road Ahead

Glimmer Finance has an ambitious roadmap:

- Q2 2025: Presale and community building.

- Q3 2025: Beta platform launch with AI features.

- Q1 2026: Expanded asset listings and risk tools.

- Q2 2026: Multi-chain integration with Ethereum and others.

By Q3 2026, Glimmer aims to be the leading RWA marketplace, with deflationary token burns to boost $GLIMM's value.

Why You Should Join Glimmer Finance

Glimmer Finance isn't just another crypto project — it's a movement to make wealth-building accessible to everyone. Whether you're looking to diversify your portfolio, earn passive income through staking, or simply explore the future of finance, Glimmer has something for you. The ongoing $GLIMM presale is your chance to get in early, with prices rising as the campaign advances.

Take action now: Visit https://glimmer.finance/SEXeAPgIZLu7 to join the presale and become part of this revolutionary ecosystem. By using this referral link, you're supporting the community and securing your place in the RWA revolution.

What do you think about tokenized assets? Have you explored RWA platforms before, or is Glimmer Finance your first step into this space? Share your thoughts in the comments below — I'd love to hear your perspective!

source: https://raglup.medium.com/glimmer-finance-the-first-real-world-asset-marketplace-on-solana-0ae518f9c120?source=rss-f56f44caad34------2